Tariffs have become a buzzword in recent years, with many countries imposing new taxes on imported goods. But what exactly are tariffs, and how do they work? In this article, we'll break down the basics of tariffs and explore five key things to know about these trade barriers.

What are Tariffs?

Tariffs are taxes imposed by governments on imported goods and services. They are typically levied as a percentage of the value of the imported goods, and the revenue collected is used to fund government activities. Tariffs can be imposed on a wide range of products, from agricultural goods to manufactured goods, and can have a significant impact on global trade.

5 Things to Know About Tariffs

1.

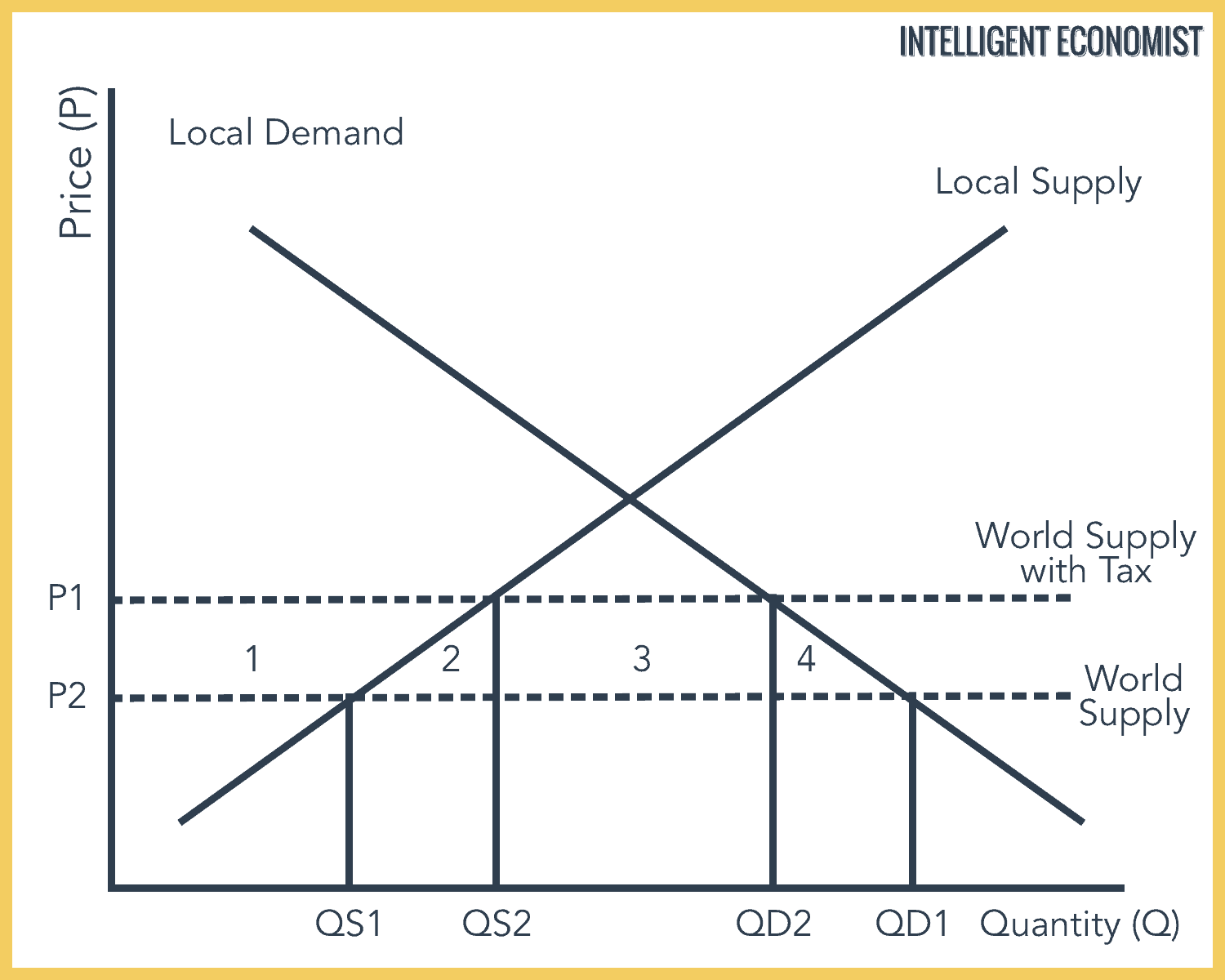

Tariffs are used to protect domestic industries: One of the primary reasons governments impose tariffs is to protect domestic industries from foreign competition. By making imported goods more expensive, tariffs can give domestic producers a competitive advantage in the market.

2.

Tariffs can increase costs for consumers: When tariffs are imposed, the cost of imported goods increases, which can lead to higher prices for consumers. This can be particularly problematic for low-income households, who may struggle to afford essential goods and services.

3.

Tariffs can lead to trade wars: When one country imposes tariffs on another country's goods, the affected country may retaliate by imposing its own tariffs. This can lead to a trade war, where both countries impose increasingly higher tariffs on each other's goods, resulting in significant economic losses for both sides.

4.

Tariffs can have unintended consequences: Tariffs can have unintended consequences, such as encouraging companies to move their production to countries with lower tariffs. This can lead to job losses and economic disruption in the country imposing the tariffs.

5.

Tariffs are not the only trade barrier: While tariffs are one type of trade barrier, they are not the only one. Other trade barriers, such as quotas, subsidies, and regulatory requirements, can also restrict trade and have significant economic impacts.

Real-World Examples of Tariffs in Action

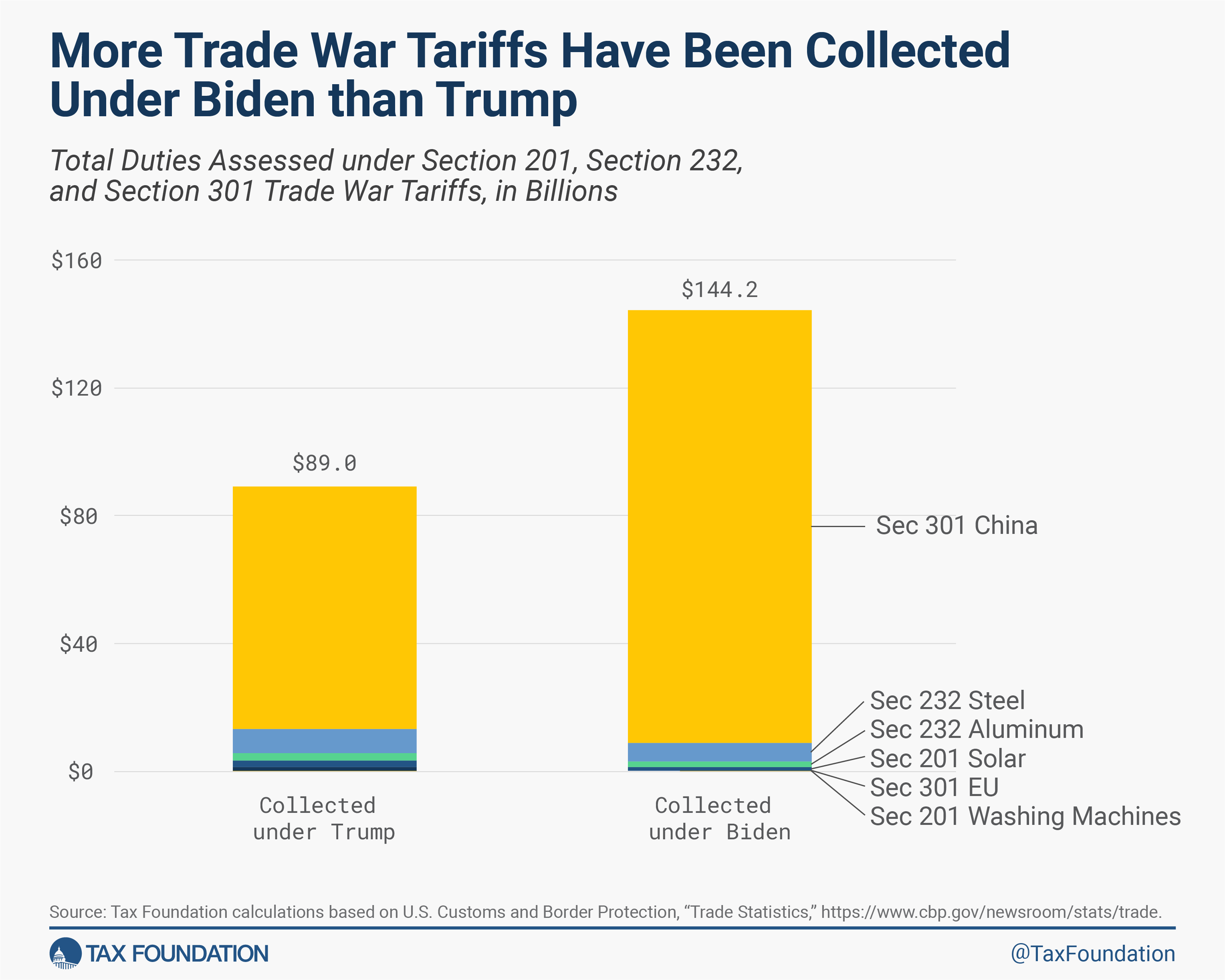

The impact of tariffs can be seen in recent trade disputes between the United States and China. In 2018, the US imposed tariffs on Chinese goods worth over $360 billion, leading to retaliatory tariffs from China. The trade war resulted in significant economic losses for both countries, with the US trade deficit with China increasing by over 10% in 2019.

In conclusion, tariffs are a complex and multifaceted issue that can have significant impacts on global trade and economies. By understanding how tariffs work and the potential consequences of their imposition, we can better navigate the complexities of international trade and work towards creating a more equitable and prosperous global economy. Whether you're a business owner, consumer, or simply interested in global affairs, it's essential to stay informed about tariffs and their role in shaping the world economy.

Source: PBS News

Note: This article is for informational purposes only and is not intended to provide investment or tax advice.