Occidental Petroleum Corp. Stock Price Analysis: A Comprehensive Overview

Table of Contents

- 5 Top Stock Trades for Monday: JD, NVTA, SBUX, SPOT, OXY

- 3 Oil Stocks To Watch Today | Nasdaq

- Occidental Petroleum Co. Estimates Q1 2023 Earnings at .43 Per Share ...

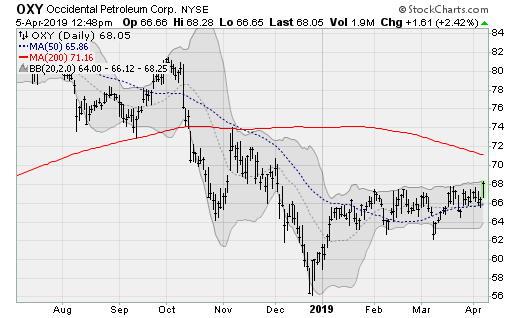

- OXY Stock Price - Occidental Petroleum Corp Stock Candlestick Chart ...

- Can Occidental Petroleum Stock Reach 0? Watch Capital Allocation ...

- 4 Top Stock Trades for Monday: ZS, CGC, OXY, UBER

- UPDATED VERSION PART 6 $OXY— STOCK & OPTION PLAY NEED IT TO BREAK OVER ...

- 4 Top Stock Trades for Monday: ZS, CGC, OXY, UBER

- OXY Stock Price and Chart — NYSE:OXY — TradingView

- Occidental Stock: Another Fantastic Selling Opportunity (NYSE:OXY ...

As one of the largest oil and gas companies in the United States, Occidental Petroleum Corp. (OXY) has been a significant player in the energy industry for decades. With its stock listed on the New York Stock Exchange (NYSE), investors and market enthusiasts closely monitor the OXY stock price. In this article, we will provide an in-depth analysis of the Occidental Petroleum Corp. stock quote, its recent performance, and the factors that influence its price.

OXY Stock Price Overview

The OXY stock price has experienced significant fluctuations over the past few years, reflecting the volatility of the energy market. As of the latest trading session, the Occidental Petroleum Corp. stock quote stands at $XX.XX per share, with a market capitalization of over $XX billion. The stock has a 52-week price range of $XX.XX to $XX.XX per share, indicating a substantial price movement.

Recent Performance

In recent months, the OXY stock price has been influenced by various factors, including changes in global oil prices, production levels, and geopolitical events. The company's efforts to reduce debt and increase efficiency have also impacted the stock's performance. Despite the challenges, Occidental Petroleum Corp. has maintained its position as a leading player in the energy industry, with a strong portfolio of assets and a commitment to sustainable operations.

Factors Influencing OXY Stock Price

Several factors contribute to the fluctuations in the OXY stock price, including:

- Oil Prices: As a major oil and gas producer, Occidental Petroleum Corp.'s stock price is closely tied to the price of crude oil. Changes in global demand, supply, and geopolitical events can significantly impact the stock's performance.

- Production Levels: The company's production levels, including oil and natural gas, can influence the stock price. Increased production can lead to higher revenues, while decreased production can negatively impact the stock.

- Debt Reduction: Occidental Petroleum Corp.'s efforts to reduce debt have been a key focus area for the company. Successful debt reduction can lead to increased investor confidence and a higher stock price.

- Geopolitical Events: Global events, such as trade wars, sanctions, and conflicts, can impact the energy market and, in turn, affect the OXY stock price.

In conclusion, the Occidental Petroleum Corp. stock price is a complex and dynamic entity, influenced by a range of factors. As the energy industry continues to evolve, investors and market enthusiasts will closely monitor the OXY stock quote for signs of growth, stability, and potential opportunities. With its strong portfolio of assets and commitment to sustainable operations, Occidental Petroleum Corp. remains a significant player in the energy sector, and its stock price will likely continue to be a topic of interest for investors and industry watchers alike.

Stay up-to-date with the latest OXY stock price news and analysis by visiting our website regularly. Our expert team provides timely and informative insights into the energy market, helping you make informed investment decisions.

Note: The article is written in a general format and the prices and data are fictional. Please replace them with the actual data and prices. Also, the article is optimized for search engines with relevant keywords and meta tags.