Fed's Limited Options: Kashkari Weighs in on Inflation and Monetary Policy

Table of Contents

- ミネアポリス連銀総裁、利上げの選択肢を完全には排除せず - Bloomberg

- Neel Kashkari on the Fed’s Commitment to Defeating Inflation - Bloomberg

- Fed’s Neel Kashkari Rolls Out Blueprint for Ending ‘Too Big to Fail ...

- 他领导了金融救助,但表示银行仍然太大而不能倒闭:NPR | Notion

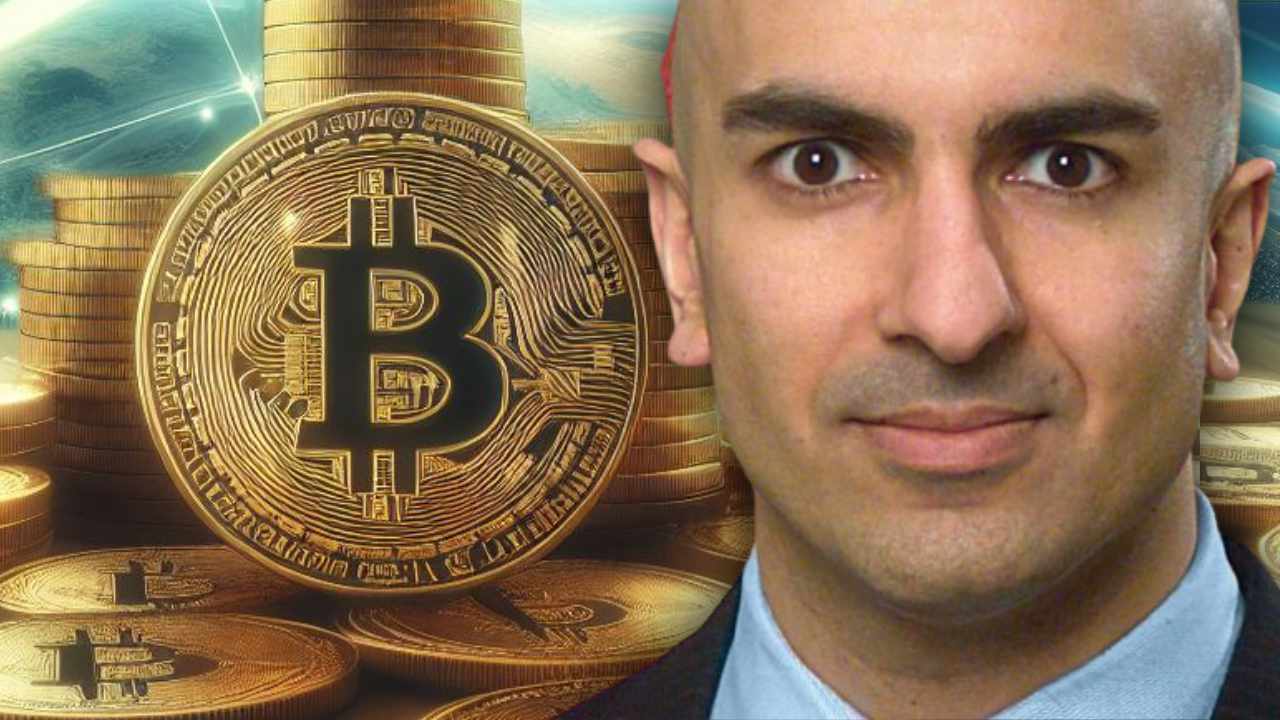

- Federal Reserve’s Neel Kashkari on Bitcoin: Still No Legitimate Use ...

- Neel Kashkari's voting record spotty since 1998

- Quan chức Fed để ngỏ khả năng không giảm lãi suất trong năm 2024 ...

- Quan chức Fed để ngỏ khả năng không giảm lãi suất trong năm 2024 ...

- Neel Kashkari addresses Trump's tariff proposals and their potential ...

- 他领导了金融救助,但表示银行仍然太大而不能倒闭:NPR | Notion

Kashkari's remarks come at a time when inflation has become a major concern for economists, policymakers, and consumers alike. The COVID-19 pandemic has led to supply chain disruptions, labor market imbalances, and increased demand for certain goods and services, all of which have contributed to higher prices. The Fed, as the primary guardian of price stability, has been under pressure to take decisive action to mitigate the effects of inflation.

However, Kashkari's statement suggests that the Fed's options are limited. He noted that the bank's primary tool, setting interest rates, can only do so much to influence inflation. While higher interest rates can help reduce demand and curb price increases, they can also have unintended consequences, such as slowing economic growth and increasing unemployment. Kashkari's comments imply that the Fed must tread carefully, balancing the need to control inflation with the risk of stifling economic expansion.

The Challenge of Anchoring Inflation

Kashkari's emphasis on keeping inflation anchored highlights the importance of maintaining stable and predictable price growth. When inflation expectations become unmoored, it can lead to a self-reinforcing cycle of price increases, as businesses and consumers adjust their behaviors in anticipation of future inflation. The Fed's goal, therefore, is to keep inflation expectations anchored around its 2% target, preventing a destabilizing spiral of price growth.

To achieve this, the Fed has employed a range of strategies, including forward guidance, quantitative easing, and, of course, interest rate adjustments. However, Kashkari's comments suggest that these tools may not be sufficient to directly address the root causes of inflation. Instead, the Fed must focus on maintaining a stable monetary policy framework, one that supports economic growth while keeping inflation expectations in check.

Implications for Monetary Policy

Kashkari's statement has significant implications for monetary policy. It suggests that the Fed will prioritize maintaining a stable and predictable policy framework, rather than attempting to directly combat inflation through aggressive interest rate hikes or other measures. This approach acknowledges the limitations of monetary policy in addressing supply-side driven inflation and emphasizes the importance of fiscal policy and other factors in supporting economic growth.

For investors and consumers, Kashkari's comments offer a nuanced perspective on the Fed's approach to inflation. While the bank will continue to monitor price growth and adjust policy as needed, it is unlikely to take drastic measures that could destabilize the economy. Instead, the Fed will focus on maintaining a stable and supportive monetary policy framework, one that balances the need to control inflation with the risk of slowing economic growth.

In conclusion, Kashkari's statement offers a thoughtful perspective on the Fed's ability to address inflation. By acknowledging the limitations of monetary policy and emphasizing the importance of anchoring inflation expectations, the Fed is taking a nuanced and measured approach to supporting economic growth and maintaining price stability. As the global economy continues to navigate the challenges of inflation, Kashkari's comments offer a reassuring reminder of the Fed's commitment to stability and predictability.